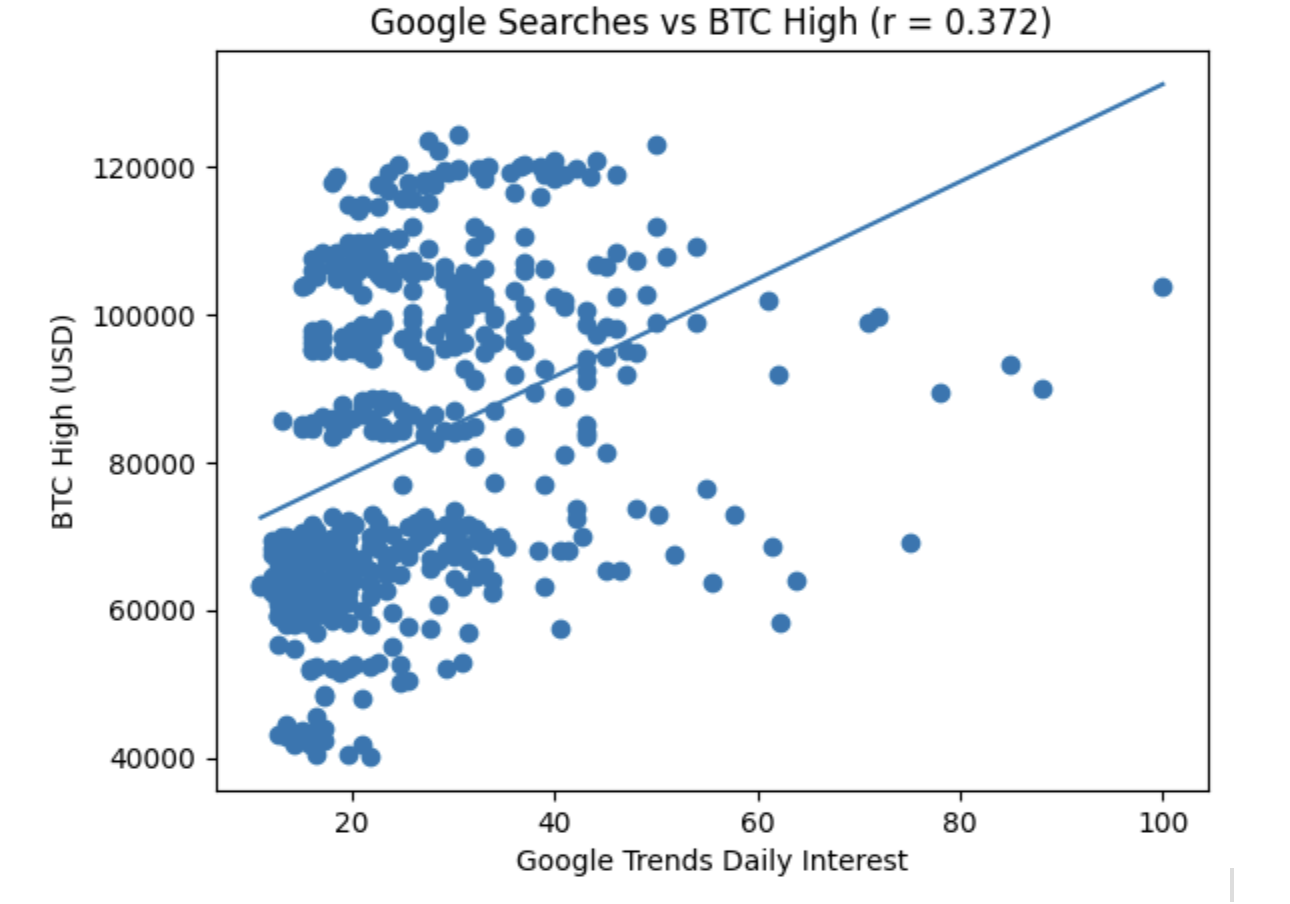

Over the past year, I’ve been looking at the relationship between Google search activity for Bitcoin and actual BTC price movements.

The intuition is simple: if more people are searching “Bitcoin,” that could reflect higher public interest, and maybe even predict price surges. But is that really the case?

Major Market Dates

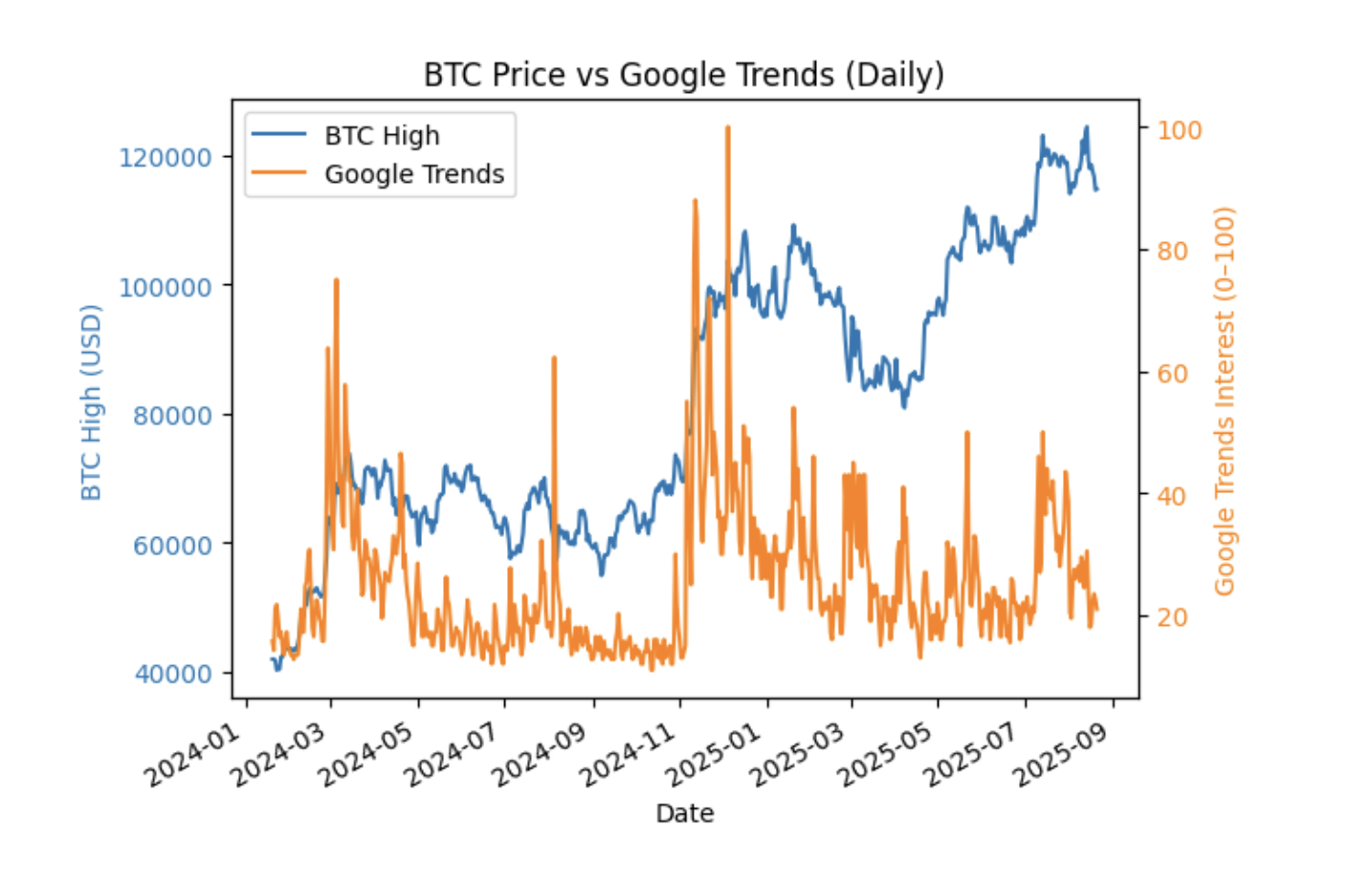

- January 2024 → SEC approves 11 Bitcoin ETFs that hold BTC directly (not just futures). A landmark step for institutional adoption.

- November 2024 → Bitcoin breaks past $103,000, making up 55.2% of the entire cryptocurrency market value.

- January 2025 and after → Google searches for “Bitcoin” stabilize at 15–55 searches per day. Small peaks align with price jumps, but the spikes are far less dramatic than in past bull runs.

What the Data Shows

Looking at the trends, one thing is clear:

-

Searches follow the price.

Google searches tend to rise after Bitcoin makes a major move, not before. -

Peaks in attention are smaller.

Compared to the mania of 2017 or 2021, the public search interest feels muted. Investors may now be tracking BTC via trading platforms and news feeds rather than Google. -

Correlation ≠ causation.

Yes, we see correlation: when prices surge, searches spike. But there’s no evidence that searches are causing the surges.

The Causality Challenge

So if searches aren’t predictive, what is?

To find the cause behind surges, we need to dig deeper into crypto’s unique market structure.

Some likely drivers:

- Exchange flows (capital moving in/out of exchanges)

- On-chain analytics (whale activity, wallet movements)

- Derivatives (open interest, funding rates, liquidations)

- Macro triggers (monetary policy, regulations, ETF inflows)

Google searches, in this context, are more of a sentiment barometer than a forecasting tool.

Closing Thoughts

Right now, Google search data looks more reactionary than predictive.

It helps measure the public’s interest in Bitcoin — but doesn’t explain why BTC surges happen in the first place.

The next step is clear: broaden the dataset. That means pulling in on-chain data, market flows, and even social media activity, to see how hype cycles connect to price action.

In other words, the searches tell us when people are paying attention. But to know why Bitcoin moves, we’ll need a much richer view of the ecosystem.